Since its inception in 1968, Section 3 of the HUD Act has played a pivotal role in creating job opportunities and economic advancement for low- and very-low-income individuals. This provision has supported generations of workers, particularly in public works, community development, and housing construction and rehabilitation projects. However, compliance is key—and it’s triggered whenever HUD funding exceeds $200,000.

In this blog post, we’ll explore what Section 3 is, how it works, the differences between Section 3 and Targeted Section 3, and what changed with the New Rule (24 CFR Part 75) enacted in 2020.

What Triggers Section 3 Requirements?

Section 3 workforce requirements apply to any project receiving $200,000 or more in HUD funding, whether in full or partial amounts. This ensures that a portion of the project’s economic benefits flows to those who need it most: low-income individuals and businesses that serve them.

Projects funded under Section 3 fall into two main categories:

- Public Housing Financial Assistance (PHA)

- Housing and Community Development Financial Assistance (HCD)

Both categories aim to increase employment opportunities for eligible workers, but they have slightly different criteria for qualifying individuals.

Section 3 vs. Targeted Section 3: What’s the Difference?

Understanding the distinction between Section 3 and Targeted Section 3 workers is critical for compliance:

Section 3 Workers:

An individual qualifies as a Section 3 worker if they meet one of the following criteria:- Have an annual income below the HUD-established threshold for the county or MSA (Metropolitan Statistical Area) they reside in.

- Are employed by a Section 3-certified business.

- Participate in YouthBuild, a program for 16- to 24-year-olds without a high school diploma.

Targeted Section 3 Workers:

This designation adds specific location-based criteria:- For PHA funding, workers must reside in public or Section 8-assisted housing.

- For HCD funding, workers must live in the project’s service area or neighborhood, as defined by HUD regulations (24 CFR § 75.5).

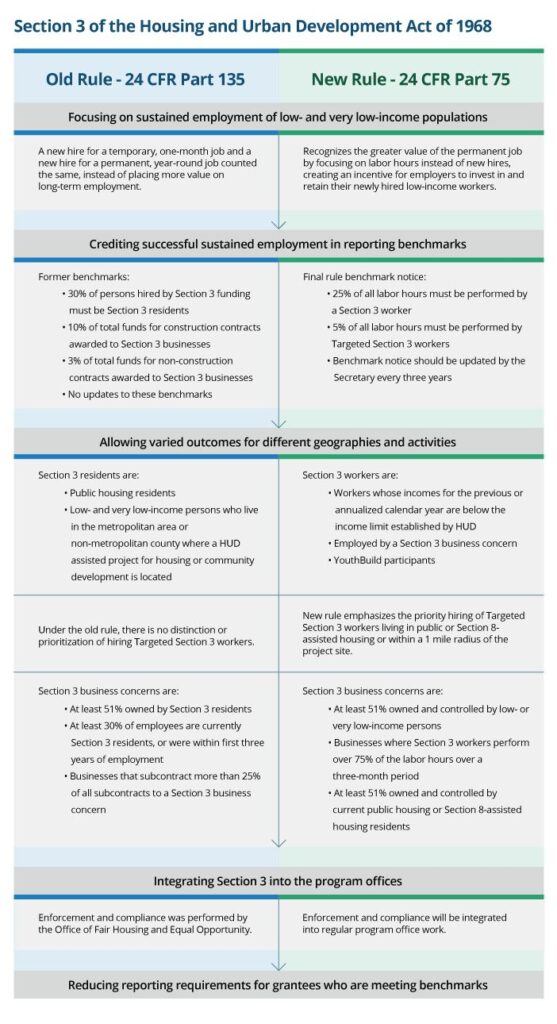

Key Changes with the 2020 Final Rule

In November 2020, HUD implemented the Final Rule, significantly altering how Section 3 compliance is measured and reported. Here are the most critical updates:

Labor Hours, Not Worker Headcount:

Funding is now contingent on the total labor hours worked by Section 3 and Targeted Section 3 workers rather than the number of workers hired.- 25% of total labor hours must be completed by Section 3 workers.

- 5% of total labor hours must be worked by Targeted Section 3 workers.

Importantly, labor hours worked by Targeted Section 3 workers can count toward both the 25% and 5% requirements.

Enhanced Data Tracking:

Contractors and project owners must collect and report additional demographic data about Section 3 workers. These updated tracking requirements are essential for demonstrating compliance under the new rules.Applicability of the Final Rule:

The new standards apply only to projects awarded after the Final Rule’s enactment. Projects that began before the Final Rule are governed by the previous regulations.

Compliance and Additional Considerations

All HUD-funded projects exceeding $200,000 must comply with Davis-Bacon prevailing wage requirements, in addition to Section 3 provisions. Contractors must understand the distinctions between old and new standards and maintain thorough records of labor hours and worker demographics to ensure compliance.

By understanding the compliance triggers, worker classifications, and updates under the 2020 Final Rule, contractors can ensure that they meet all regulatory requirements while contributing to community development.